Long Island firms receive relatively little venture capital. Investment has declined since 2011.

Why is this important?

New venture capital investment is an indicator of innovation and dynamism within the economy. Venture capitalists generally seek to invest in new enterprises that have a potential for strong growth. Typically, only firms with potential for exceptionally high rates of growth over a 5- to 10-year period will attract venture capital. Thus, a high rate of venture capitalist investment suggests a changing and dynamic economy with relatively new enterprises entering the scene. A lower rate of venture capitalist investment suggests a less dynamic mix of economic enterprises in the regional economy.

How are we doing?

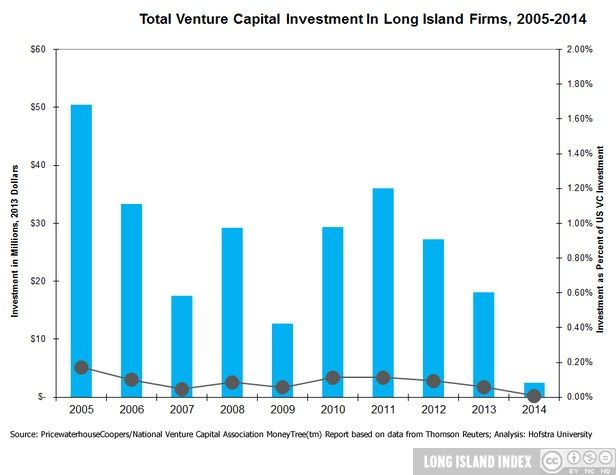

From 2005 to 2014 Long Island on average received 0.08% of all venture capital invested in the United States. 2011 represented Long Island’s best performance since the pre-recession years of 2005 and 2006. However, venture capital investments have fallen each year since 2011. Long Island continues to receive less venture capital relative to the size of its economy as compared to the U.S. as a whole.

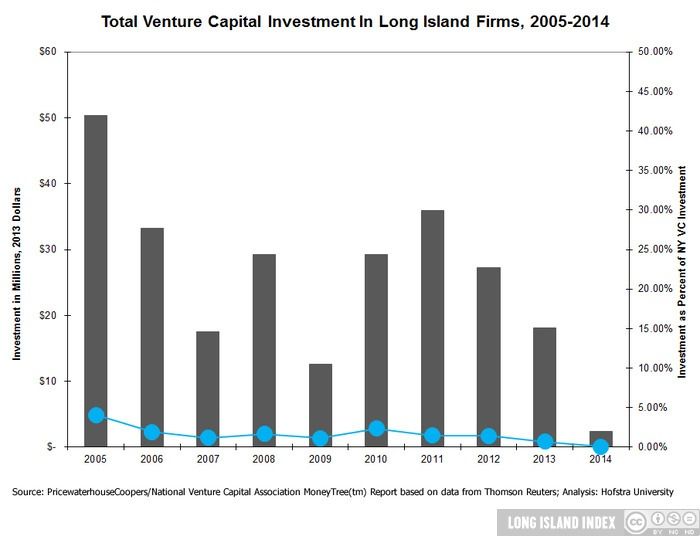

Between 2005 and 2014, Long Island averaged about 1.4 % of all venture capital investment in New York State. Similar to the national pattern, Long Island’s share of NYS venture capital activity fell between 2011 and 2014.

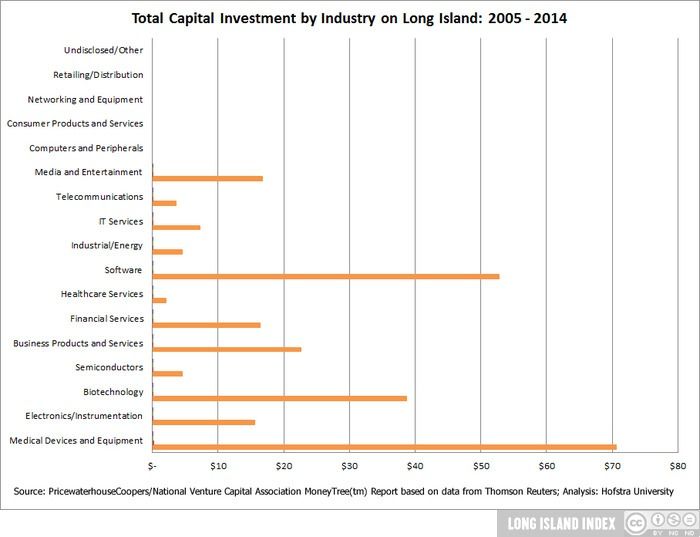

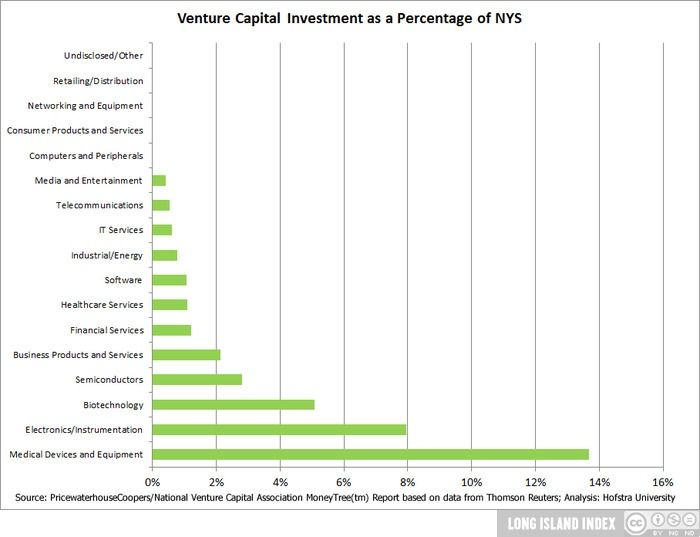

Venture Capital is not invested evenly across Long Island Industries, however. Some industries attract more interested than do others. With respect to the amount invested between 2005 and 2014, Medical Devices and Equipment ($71 million), and Software ($53 million) attracted the most venture capital. Some industrial sectors, like retail, networking, and consumer products and services attracted no venture capital whatsoever. With respect to Long Island’s share of New York State venture capital, it can be seen that Medical Devices and Equipment (13.7%), the Electronics/Instrumentation (8%), and Biotechnology (5%) attracted the highest percentages of total New York State venture capital in those industrial sectors. It should be noted that these figures as a percent of New York State totals are generally lower than those reported two years ago.