Employment declines continue in the aftermath of the recession in some sectors; others show signs of growth. The largest employment losses occurred in higher-paying sectors.

Why is this important?

Long Island’s industry clusters make up approximately 70% of Long Island’s employment base. An industry cluster is a geographic concentration of interdependent firms in related industries and includes a significant number of companies that sell their products and services outside the region.

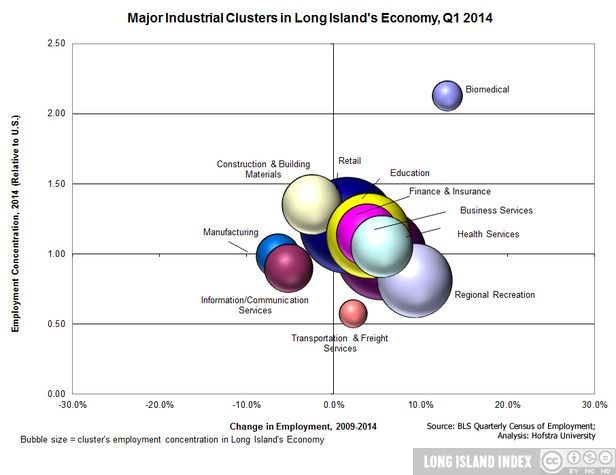

Chart 1

The first bubble chart illustrates three key dimensions of Long Island’s industry clusters:

- The vertical axis indicates an industry’s Employment Concentration in Long Island.

- A concentration greater than one indicates that Long Island “specializes” in that cluster. That is, compared to the national average, Long Island has more employment in that sector.

- The horizontal axis, Change in Employment 2009-2014, shows each cluster’s job growth or contraction in Long Island for the last five years.

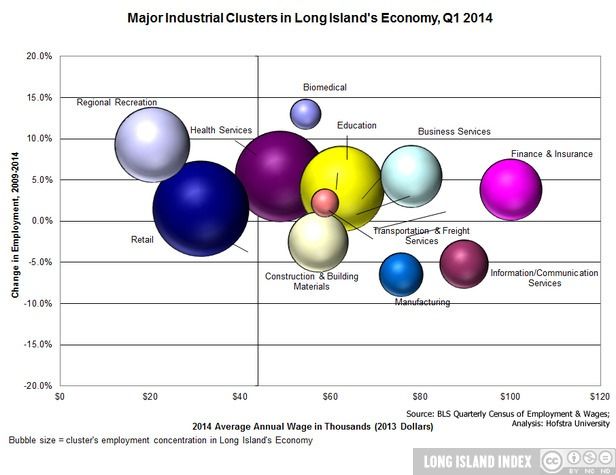

- The size of the circle reflects, for Long Island in 2014, the percentage of Long Island jobs located in that cluster. The second bubble chart plots Change in Employment (now the vertical axis) by Wages (horizontal axis). The size of the circle is the same as above, percent of Long Island jobs in that cluster.

On each chart, the desirable position is the upper right quadrant. It represents the most positive indicators in concentration and employment (first chart) and employment and wages (second chart).

Chart 2

How are we doing?

Reading the two charts in relationship to each other, an important trend becomes apparent. Overall, employment in several strategic clusters continues to decline (Construction, Manufacturing, and Information/Communication Services. This reflects the prolonged effects of the economic recession. Several sectors – Biomedical, Health Services, Business and Education – show moderate employment gains between 2009 and the first quarter of 2014. All sectors except for Business Services pay about average or below-average wages. The largest losses in employment are occurring in those sectors with the highest average wages (Manufacturing, Finance and Insurance, Information/Communication Services).

- The first chart shows that in general Long Island has a mixture and concentration of industrial clusters not dissimilar to the pattern in the United States as a whole. Other than Biomedical at the high end, and Transportation at the low end, the concentration of clusters is relatively close to the national norm. The other sector worth noting is Construction & Building Materials. This sector, with 5.4% of Long Island employment, is one of the more concentrated industrial sectors relative to the U.S. As a whole, it has lost substantial employment since the start of the recession. However, the job losses are easing somewhat. Between 2009 and 2014 this sector declined by 2.5. Overall, Long Island’s economy reflects a similar pattern to the U.S. as a whole with respect to the relative presence of these clusters.

- The clusters experiencing the greatest employment growth are Biomedical (13%), Regional Recreation (9.3%), Business Services (4.5%), and Health Services (5.5%). The second Chart indicates that the Biomedical sector offers slightly above average pay, and Regional Recreation substantially below average pay, while the latter two pay above median level wages.

- Those clusters yielding the highest average pay tend to be both the smaller sectors and those that have experienced employment declines between 2009 and 2014. This follows trends noted in recent prior reports (Information and Communication Services fell 5.2%, Manufacturing fell 6.4%, and Construction and Building Materials fell 2.5%). The two higher-paying sectors running counter to this pattern were Business Services and Finance and Insurance.

Growth:

Education and Health Services together represent 23% of all Long Island employment. Both sectors have experienced slight to moderate growth in employment. Education is more concentrated in Long Island than in the rest of the US, and it pays better than average wages. Health Services pays about average wages. Long Island’s concentration of health services employment is on par with the national average.

In terms of absolute numbers, Long Island’s biggest cluster and third highest concentration is Retail. It represents 13.7% of all Long Island jobs. Retail jobs pay below average wages.

The Finance and Insurance sector, while a relatively small source of jobs (5.4% of employment), pays well above median wages and showed signs of slight job growth between 2009 and 2014.

Contraction:

Manufacturing in Long Island continues to contract. Since 2009, it has seen a 6.4% employment decline. At this point, this sector is no more concentrated on Long Island than as for the nation as a whole. It now represents only 3% of all Long Island employment. Manufacturing jobs tend to pay well.

Long Island’s second most concentrated industry, Construction & Building has also seen substantial shrinkage. Employment has fallen another 2.5% in the past five years and now accounts for about 5% of all Long Island jobs. Construction jobs pay better than the US median.